Purchasing a vehicle is an exciting milestone, but it can also be a risky endeavor if you’re not prepared. At Consumer Action Law Group, we’ve seen firsthand how auto fraud can turn a dream purchase into a financial nightmare for California consumers. With the risk of fraudulent auto lending projected to reach between $4 billion and $6 billion annually, it’s more important than ever to be informed and vigilant when buying or financing a vehicle.

This guide will walk you through the common types of auto dealer fraud, from bait-and-switch tactics to hidden add-ons and odometer rollbacks. We’ll provide practical tips to protect yourself during the buying process, explain how to spot red flags, and offer insights into safe financing practices. By arming yourself with knowledge and understanding your rights as a consumer, you’ll be better equipped to make informed decisions and avoid potential scams. Let’s explore how you can navigate the car-buying journey safely and confidently in California.

Minimize Risk of Fraud in Auto Lending

Auto lending fraud is an ever-growing issue that could cost you thousands of dollars if you’re not vigilant. According to PointPredictive, a San Diego startup specializing in fraud detection, the risk for fraudulent auto lending is projected to reach between $4 billion and $6 billion annually. This significant increase from the $2 billion to $3 billion risk in 2015 highlights the urgency of understanding and avoiding auto dealer fraud.

What is Auto Dealer Fraud?

Auto dealer fraud encompasses a range of deceptive and unlawful practices used by car dealers during the vehicle purchase process. These practices include false advertising, unlawfully negotiating vehicle prices and financing terms, adding hidden markups, and failing to disclose prior damage to the vehicle.

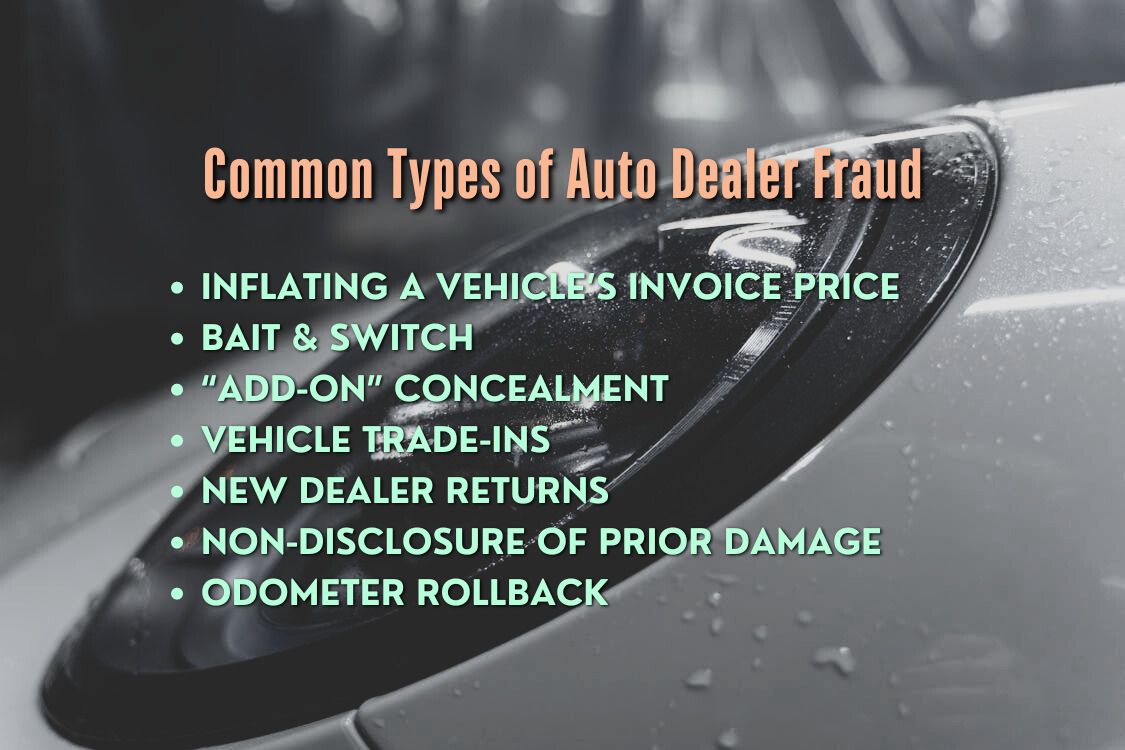

Common Types of Auto Dealer Fraud

Inflating a Vehicle’s Invoice Price

Dealers may advertise special pricing to lure buyers. Once a buyer arrives, the dealer increases the price dramatically. They may also add hidden markups, starting negotiations above the Manufacturer’s Suggested Retail Price (MSRP).

Bait & Switch

How It Works

In a bait-and-switch scam, dealers lure customers with advertisements for a vehicle at a seemingly unbeatable price. These vehicles often have desirable features and are listed at a price lower than market value to attract attention. However, when the customer arrives at the dealership, they are informed that the advertised vehicle is either sold, unavailable, or non-existent.

Dealer Tactics

The dealer then directs the customer to other vehicles that are significantly more expensive or lack the advertised features. They may use high-pressure sales tactics to convince the buyer that these alternative vehicles are a better deal, even though they cost more. The goal is to make the customer feel that they need to make a quick decision before the “good” deals are gone.

How to Protect Yourself

- Call Ahead: Verify the availability of the advertised vehicle before visiting the dealership.

- Get Written Confirmation: Request a written statement from the dealer confirming the price and availability.

- Research Dealer Reputation: Check online reviews and ratings to see if other customers have reported similar experiences.

“Add-on” Concealment

How It Works

Add-on concealment occurs when dealers hide the cost of additional products or services within the final sale price of the vehicle. During negotiations, the dealer may not disclose these extras or their prices, making it seem as though they are part of the standard package or included at no extra cost.

Common Add-ons

- Extended Warranties: These can significantly increase the overall price and are often presented as essential.

- Maintenance Programs: Dealers may include costly maintenance plans without informing the buyer.

- Security Systems: High-priced security systems can be added without the buyer’s knowledge.

- Gap Insurance: This covers the difference between the loan amount and the vehicle’s value if it’s totaled, but it is often overpriced.

How to Protect Yourself

- Review the Contract Thoroughly: Ensure all add-ons are clearly listed and their costs are explicitly stated.

- Ask Questions: Don’t hesitate to ask about any charges that you don’t understand or didn’t agree to.

- Decline Unnecessary Extras: If you don’t want or need additional products, make it clear that you are not interested.

Vehicle Trade-ins

How It Works

When trading in a vehicle, some dealers may undervalue the trade-in to maximize their profit. They might use various tactics to justify a lower offer, such as exaggerating minor flaws or devaluing the vehicle based on incomplete or inaccurate assessments.

Dealer Tactics

- Lowball Offers: Dealers may provide an initial low offer, hoping the customer will accept it without question.

- Negative Comments: They might point out every minor defect or issue to justify a lower value.

- Misleading Comparisons: Comparing your trade-in to vehicles in worse condition to make their offer seem fair.

How to Protect Yourself

- Get Multiple Appraisals: Visit several dealerships to get a range of offers for your trade-in.

- Use Online Tools: Websites like Kelley Blue Book or Edmunds can provide an estimated trade-in value based on your vehicle’s condition and market trends.

- Negotiate Separately: Negotiate the trade-in value separately from the new vehicle purchase to ensure clarity.

New Dealer Returns

How It Works

Some dealers resell vehicles that have been returned by previous buyers due to defects or mechanical problems. These vehicles are sometimes presented as new or barely used, without disclosing their return history or the issues that led to the return.

Dealer Tactics

- Misleading Descriptions: Labeling returned vehicles as new or “like new” without disclosing the reasons for their return.

- Quick Fixes: Performing superficial repairs to hide underlying issues that caused the return.

- Concealing Documentation: Failing to provide or disclose repair records and the vehicle’s return history.

How to Protect Yourself

- Request Full Disclosure: Ask for a complete history of the vehicle, including any returns or repairs.

- Inspect Thoroughly: Have a trusted mechanic inspect the vehicle for any signs of underlying issues.

- Use Vehicle History Reports: Services like CarFax or AutoCheck can reveal the vehicle’s history, including previous returns.

Non-Disclosure of Prior Damage

How It Works

Dealers are legally required to disclose significant damage to a vehicle, especially if it has been in a major accident. However, some may hide this information to sell the car at a higher price. This can mislead buyers about the true condition and safety of the vehicle.

Dealer Tactics

- Clean Titles: Using vehicles with clean titles that don’t reflect prior damage.

- Minimal Disclosure: Providing incomplete or vague information about the vehicle’s history.

- Repair Concealment: Performing repairs in a way that hides the extent of previous damage.

How to Protect Yourself

- Obtain a Vehicle History Report: Use services like CarFax or AutoCheck to check for any reported accidents or damage.

- Ask for Documentation: Request all repair records and documentation related to the vehicle’s history.

- Inspect the Vehicle: Have a professional mechanic inspect the vehicle for signs of previous damage, such as mismatched paint or non-factory parts.

Odometer Rollback

How It Works

An odometer rollback is a form of fraud where the odometer reading is altered to show a lower mileage than the vehicle has actually traveled. This practice is illegal but can be difficult to detect without proper diligence.

Dealer Tactics

- Electronic Tampering: Modern vehicles have electronic odometers that can be manipulated with specialized equipment.

- Physical Tampering: Older vehicles with mechanical odometers can be manually rolled back.

- Incomplete Records: Providing incomplete or falsified maintenance records to support the altered odometer reading.

How to Protect Yourself

- Cross-Check Records: Compare the odometer reading with the mileage recorded in maintenance records and vehicle history reports.

- Look for Wear and Tear: Check for signs of wear and tear that don’t match the displayed mileage, such as worn pedals or seats.

- Professional Inspection: Have a mechanic inspect the vehicle for signs of tampering.

By understanding these detailed tactics and how to protect yourself, you can minimize the risk of falling victim to auto dealer fraud. Always be vigilant, do your research, and don’t hesitate to walk away if something feels off.

Ten Ways to Avoid Auto Dealer Fraud

- Begin negotiations with the MSRP: Never let negotiations start above the Manufacturer’s Suggested Retail Price.

- Check for extras: Before signing, ensure no extras were added to the sale price or monthly payments without your agreement.

- Refuse to purchase: If you suspect bait-and-switch tactics or incomplete vehicle history disclosure, don’t feel obligated to buy.

- Verify vehicle availability: Call ahead to confirm the vehicle is in stock and request a signed statement with the quoted price.

- Scrutinize the contract: Ensure the final contract matches the negotiated terms without hidden charges.

- Use vehicle history websites: Services like CarFax and AutoCheck can reveal a vehicle’s accident history.

- Shop around for trade-ins: Compare offers from different dealerships to get a fair value for your trade-in.

- Avoid monthly payment negotiations: Negotiate the total vehicle price instead of monthly payments to prevent hidden fees.

- Check the odometer reading: Compare it against the vehicle’s maintenance records for accuracy.

- Have the vehicle inspected: Hire an independent mechanic to inspect the vehicle before purchase.

Buying an RV for the First Time

Buying an RV is an exciting yet challenging endeavor, especially for first-time buyers. Whether for vacations or exploring new places, the process of purchasing an RV involves several unique considerations to avoid scams and ensure a worthwhile investment.

What to Avoid When Buying an RV

Title Scams

Some dealerships fail to pay off loans on trade-in RVs. As a result, the new buyer becomes liable for the outstanding loans, making it impossible to re-title the RV in their name.

Rebate Scams

Dealers may promise rebates but fail to deliver after the sale. Ensure any rebates are applied before finalizing the deal.

Undisclosed Accident or Damage

Dealers might not disclose previous accidents or damage to the RV. Running a vehicle history report can reveal these issues and prevent unwanted surprises.

RV Buying Advice

- Do your research: Investigate the RV’s history using a vehicle history report.

- Inspect the RV thoroughly: Check for any signs of previous damage or repairs.

- Compare dealer claims with reports: Ensure the dealer’s description matches the vehicle history report.

Choosing the Right RV

Choosing the right RV requires vigilance to avoid fraudulent practices. If something seems suspicious, confront the dealer or find another dealership. If you suspect fraud after purchase, seek legal help immediately, as some issues require timely legal action.

The Importance of Vehicle Inspections

Why Inspections Matter

Inspections can uncover hidden damage or issues that are not immediately visible. A thorough inspection by a qualified mechanic can save you from buying a problematic vehicle. Mechanics can check for signs of previous accidents, flood damage, and other red flags.

What to Look For

During an inspection, focus on the vehicle’s:

- Engine and Transmission: Check for leaks, noises, and performance issues.

- Brakes and Suspension: Ensure they are in good condition and free from excessive wear.

- Interior and Exterior Condition: Look for signs of wear, rust, and body damage.

- Electrical Systems: Verify all lights, controls, and electronic systems are working correctly.

- Tires: Check for even wear and adequate tread depth.

Financing Fraud

Understanding Financing Terms

Many consumers fall victim to financing fraud due to a lack of understanding of the terms and conditions. It’s crucial to read and understand all loan documents before signing. Look out for:

- Unexplained Fees: Ensure all fees are disclosed upfront.

- Variable Interest Rates: Be aware of loans with variable rates that can increase your payments over time.

- Loan Packing: Some dealers may add unwanted services to the loan, increasing your total cost.

Protecting Your Investment

Extended Warranties and Service Contracts

While extended warranties and service contracts can provide peace of mind, they are often overpriced and may not cover all repairs. Research and compare options before purchasing.

Insurance Considerations

Ensure you have adequate insurance coverage for your vehicle. This includes liability, collision, and comprehensive coverage. For RV owners, specialized RV insurance is necessary to cover the unique risks associated with RV travel and usage.

Lawyers That Deal with Car Dealerships Near Me

If you’ve been defrauded by a car dealership, professional legal assistance is essential. Lawyers specializing in auto fraud can help you navigate the complexities of your case and ensure you receive the compensation you deserve.

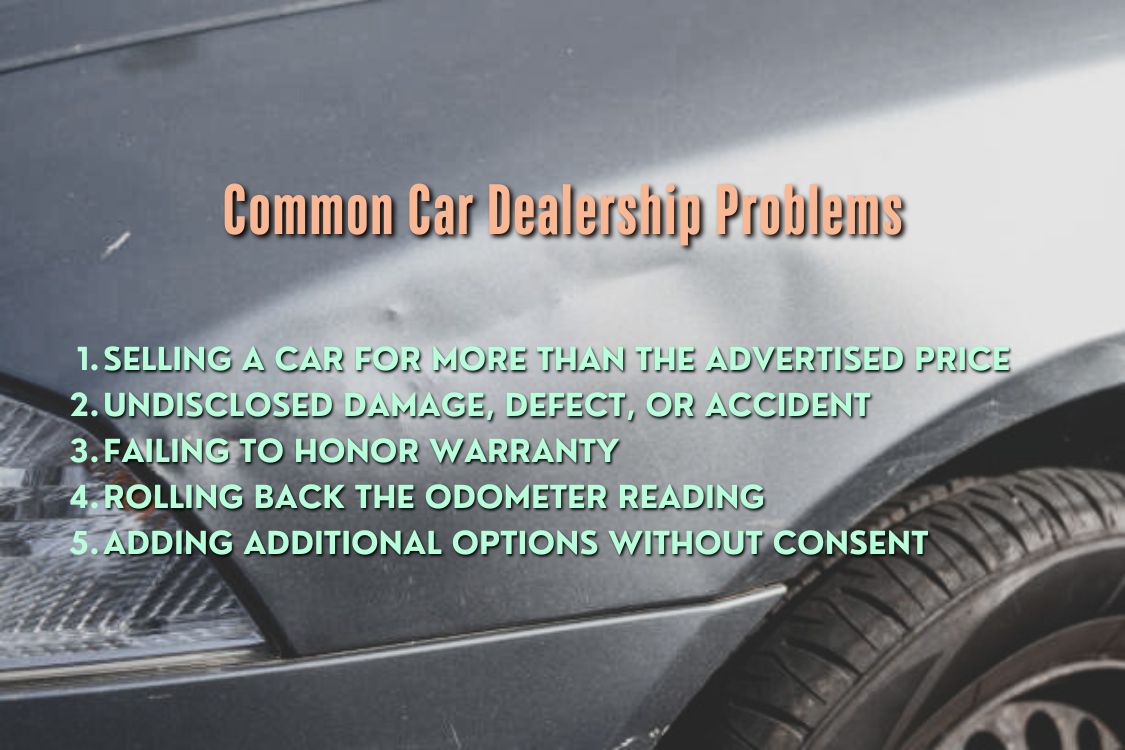

Common Car Dealership Problems

- Selling a Car for More Than the Advertised Price: Dealers may lure buyers with false advertisements and then claim the vehicle is not eligible for the advertised price. This tactic pressures buyers into spending more than expected.

- Undisclosed Damage, Defect, or Accident: Dealers often fail to disclose previous damage or defects, misrepresenting the vehicle’s value.

- Failing to Honor Warranty: Some dealerships refuse to honor warranties, especially for costly repairs. Legal intervention can pressure them to fulfill their obligations.

- Rolling Back the Odometer Reading: Dealers may roll back the odometer to hide the true mileage, increasing the vehicle’s perceived value.

- Adding Additional Options Without Consent: Dealers sometimes add features without the buyer’s knowledge, inflating the total purchase price.

Getting Legal Help

Auto fraud lawyers can help you:

- Cancel the sales contract and recover your money.

- Obtain compensation for down payments, monthly payments, and other expenses.

- Secure a new vehicle if fraud is proven.

Auto dealer fraud is a significant risk in today’s market, but with careful research and vigilance, you can protect yourself from deceptive practices. Always verify the vehicle’s history, scrutinize the contract, and consider legal assistance if you suspect fraud. Remember, being an informed buyer is your best defense against auto dealership scams.

Here’s What To Do Next

If you believe you’ve been a victim of auto dealer fraud, don’t hesitate to seek legal help. Contact our experienced auto fraud lawyers for a free consultation today. Protect your investment and ensure you get the justice you deserve. Call us at (818) 254-8413 to discuss your case and explore your legal options.

Additional Resources

Vehicle History Report Services

- CarFax: Provides detailed vehicle history reports.

- AutoCheck: Another reputable service for vehicle history checks.

Consumer Protection Agencies

- Federal Trade Commission (FTC): Offers resources and support for consumers facing fraud.

- Better Business Bureau (BBB): Provides reviews and ratings for dealerships.

Legal Assistance

- National Association of Consumer Advocates (NACA): Connects consumers with lawyers specializing in auto fraud.

By following these guidelines and utilizing available resources, you can navigate the vehicle purchasing process more confidently and reduce the risk of falling victim to auto dealer fraud. Always remain vigilant, do your research, and don’t hesitate to seek professional help if needed.